Planned Giving at IIE

Your support could have a life-changing impact

Through your estate, you have the power to fulfill your personal, financial, and philanthropic goals while laying a strong foundation for future generations to access international education and pursue their dreams. By supporting IIE, you empower us to launch and sustain initiatives that will continue to make a difference in perpetuity, leaving an indelible mark on the world.

A planned gift has benefits for everyone

You decide how to give. Start here.

Discover the giving option that works best for you to meet your goals.

Bequests are the simplest and most common form of a planned gift. Leaving a bequest to IIE can be as straightforward as including the paragraph below in your will:

“I give, devise, and bequeath the sum of $____________ or __ percent of my estate to the Institute of International Education, a nonprofit institution incorporated in the State of New York with the tax identification number 13-1624046, for its unrestricted use and purpose.”

You can support IIE and your loved ones at the time of your death through a gift from your retirement plan/IRA assets. Your estate may reap considerable tax savings through thoughtfully planning which assets will be distributed to your loved ones and which will be donated to charity. This option is revocable (you can change your beneficiary designation at any point), controllable (you retain ownership and control of your assets during your lifetime and may provide substantial income tax and estate tax benefits).

To name IIE as a beneficiary of your retirement plan/IRA, obtain a Beneficiary Designation Form from your broker and name the Institute of International Education as a beneficiary using the following legal name and address:

Institute of International Education

Federal Tax ID #13-1624046

One World Trade Center, 36th Floor

New York, NY 10007

Qualified Charitable Distributions: If you are 70 ½ or older, the IRA Qualified Charitable Distribution (QCD) can be a tax-wise way to support IIE. If you are required to make annual withdrawals from your IRA, these otherwise taxable distributions can satisfy your annual Required Minimum Distribution, exclude the funds from your taxable income, and make a gift to IIE. Learn more.

A donor-advised fund (DAF) is like a charitable investment account that is set up for the sole purpose of supporting charities. You can contribute cash, stocks, or other assets to the DAF and receive an immediate tax deduction. Those funds are invested for tax-free growth, and you may recommend donations to charities of their choice over time.

Recommend a DAF grant to IIE through your DAF giving account online or by contacting your fund manager.

IIE’s federal tax ID 13-1624046. Please provide your name and/or fund name and address so we may acknowledge your generous gift.

To electronically transfer funds to IIE, please follow the instructions here.

A gift of life insurance might be right for you if your life insurance policy is paid up or has substantial cash value, you have no loan outstanding against the policy, or if the purpose of the policy no longer applies (i.e. your children are now grown). You can donate your life insurance policy by either transferring the ownership of your policy to IIE or designating the Institute of International Education as a beneficiary of your policy.

A charitable remainder trust allows you to make a gift to The Institute of International Education while continuing to receive the interest and earnings on your investment during your lifetime and receiving a substantial charitable income tax deduction. You can choose either a fixed income or a set percentage of the value of the trust, both of which are set annually. A charitable remainder trust may allow you to avoid capital gains tax on your donated assets, and you will receive a tax deduction for a portion of your gift. The trust will provide you income for life while contributing to IIE in the future; when the trust is terminated, the remainder will pass to IIE.*

Stock or mutual funds that have been held longer than one year and have appreciated in value may be donated to IIE and may provide you with tax savings. When you give appreciated stock or securities, you avoid paying capital-gains tax on the increased value of your asset. You may also be entitled to a charitable tax deduction for the full fair market value of your stock. When considering gifts of stock, we recommend you consult with your financial adviser.

For instructions on the information you’ll need to share with your broker, email philanthropy@iie.org.

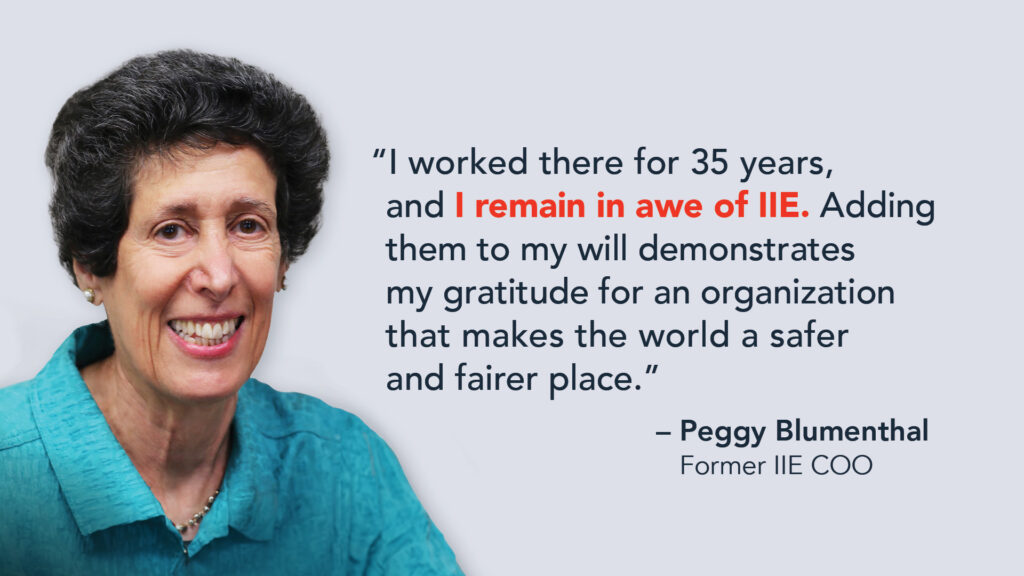

The 1919 Society

When you make a planned gift to IIE, you are automatically enrolled in the 1919 Society. Named after the year of IIE’s founding, the 1919 Society celebrates the visionary benefactors who shape IIE’s future through their estate or other planned gifts. As an individual who designates IIE as a beneficiary through their estate or a planned gift, you are personally invited to join this esteemed community of legacy partners.

If you have already included IIE in your estate planning, we express our heartfelt gratitude! We invite you to download and complete this membership form to ensure that your gift is properly recognized, and to be welcomed to the 1919 Society.

1919 Society Members Receive:

- Exclusive early access to special, members-only events and celebrations.

- Networking opportunities and exclusive virtual gatherings.

- Recognition as part of our distinguished community of legacy givers, acknowledged through various IIE materials.

- Regular updates on the progress and advancements at IIE.

Not sure where to begin?

For more information on how you can leave a lasting impact on the lives of future students, scholars, and artists, please contact:

*IIE does not provide legal, tax or financial advice. We strongly recommend that you consult professional advisors on all legal, tax, or financial matters, including gift planning considerations.